All-in-One Coverage

Protect your business from a range of risks, including property damage, liability, and business interruptions, all under one seamless policy.

Customized Solutions

Customize your coverage options based on your unique business needs, ensuring you only pay for what you require.

Simplified Claims Process

Experience a streamlined claims process that makes navigating the complexities of insurance easier than ever.

Robust Risk Management Tools

Utilize our integrated risk management features to assess potential threats and proactively mitigate risks to your operations.

Real-Time Analytics

Leverage data-driven insights to stay ahead of trends, optimize your policies, and make informed decisions that align with your business goals.

Employee Training Resources

Access a library of training materials to educate your team on safety practices and policies, helping reduce risks from the start.

24/7 Support

Rest easy knowing our dedicated support team is always available to assist you with any questions or claims, providing peace of mind at every turn.

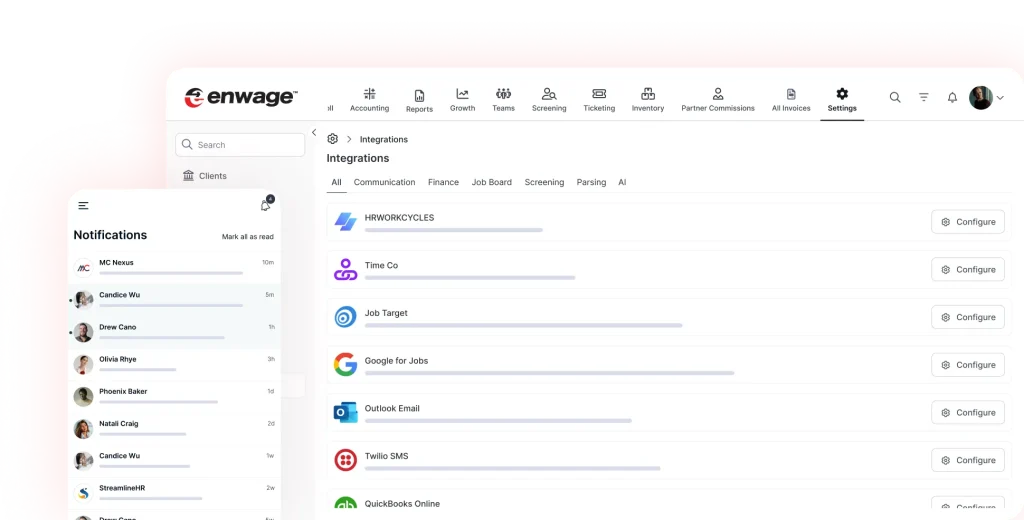

Innovative

Stay ahead with cutting-edge technology that simplifies your insurance experience.

Supportive

Rely on our team of experts who are dedicated to helping you navigate the world of insurance.

Customizable

Enjoy the flexibility to tailor your policy as your business evolves, ensuring your coverage always meets your needs.

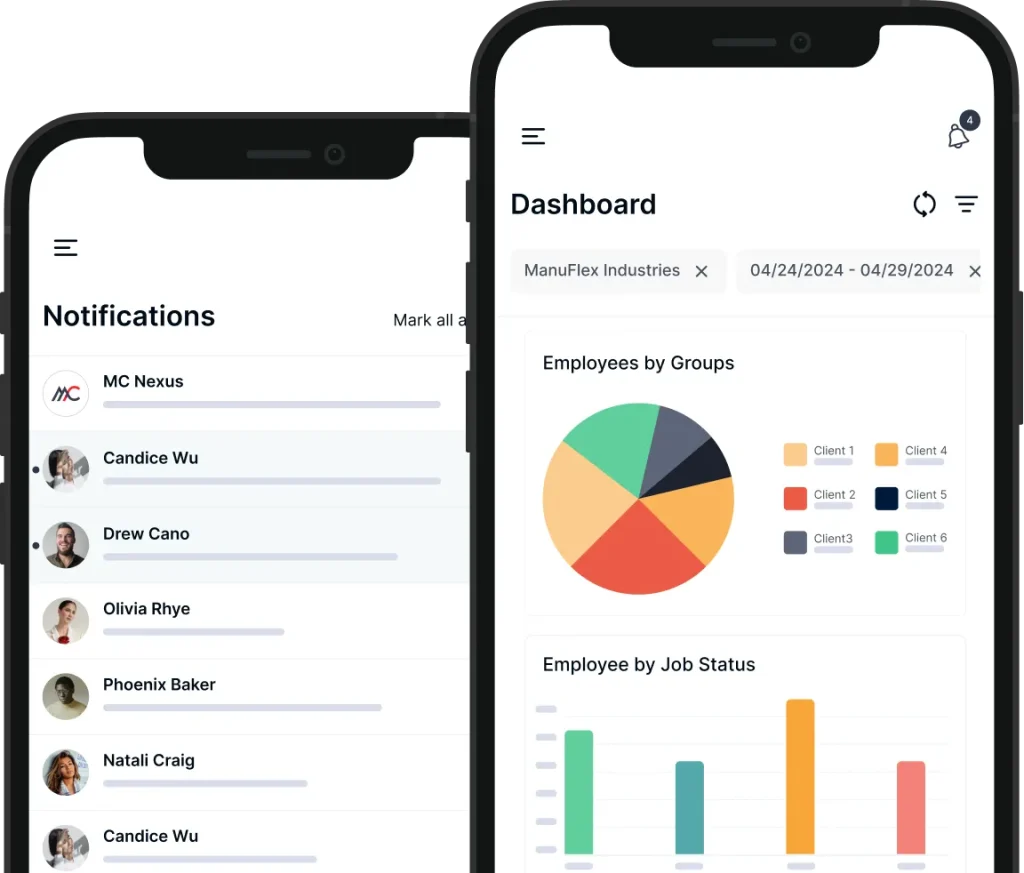

Accessible

Manage everything from your pocket with our user-friendly app, giving you control at your fingertips.

View and manage your property, liability, and business income coverage all in one user-friendly app interface.

Easily adjust your coverage as your business grows, ensuring your policy always meets your needs.

Monitor the status of your claims in real-time, keeping you informed and engaged throughout the process.

Receive personalized coverage recommendations based on your business’s unique profile and needs, right from the app.